Atlanta $1-2 Million Market Surges While Overall Market Continues to be Static

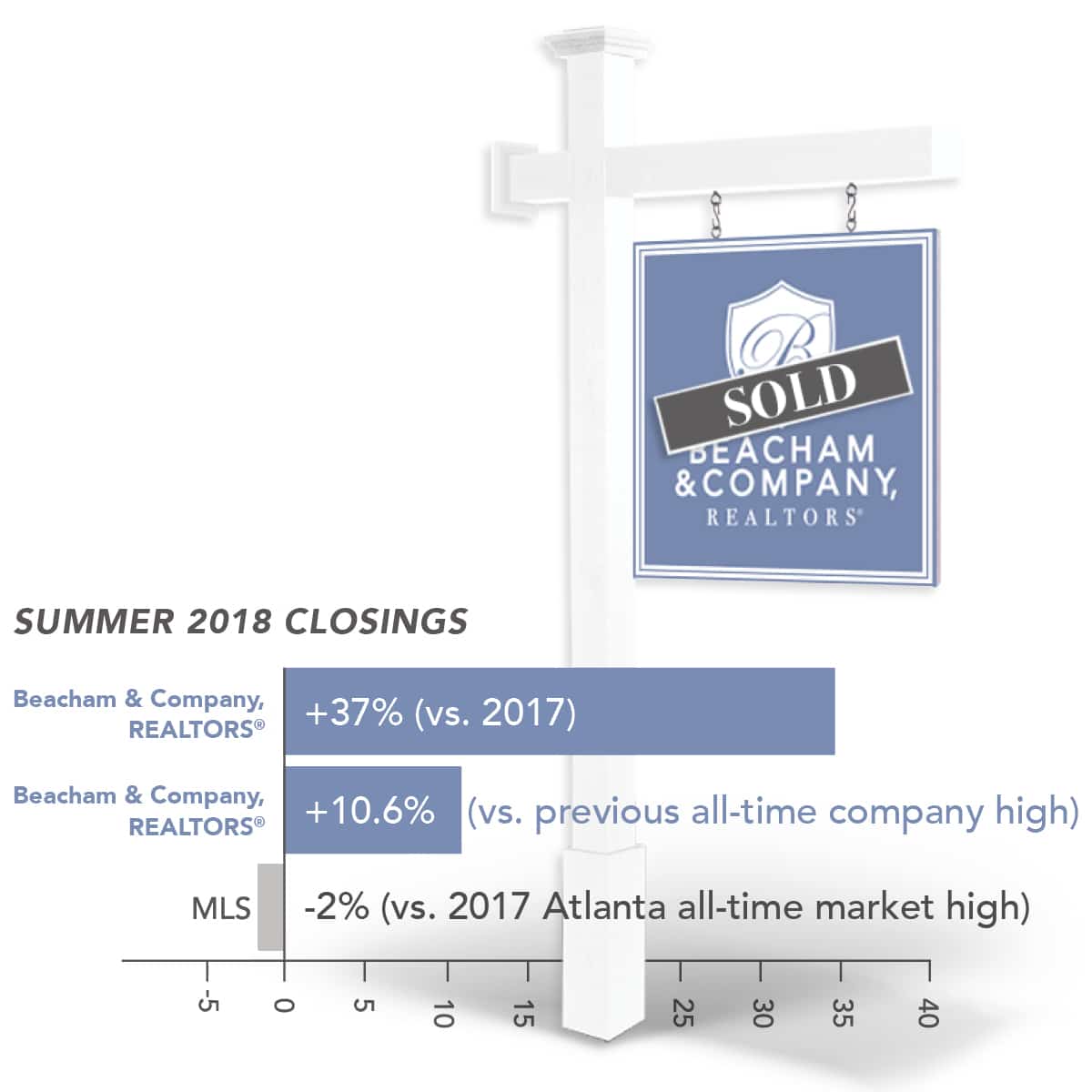

Beacham Bucks the Trend with Record Summer Closings

Atlanta’s overall home sales continued to be flat this summer, while homes sales in the $1,000,000-$2,000,000 price range increased significantly.

Sales of all single-family detached homes remained unchanged this summer compared to a year ago. Sales of attached homes (condos and townhomes), which have buoyed the market for much of the year, declined just 1%. Attached homes have remained attractive to first-time home buyers and down-sizing Baby Boomers seeking lower prices, low maintenance and value.

Since last summer, closings for both attached and detached homes have remained in line with the previous year. The reason? A lack of move-in inventory (homes that are not in need of renovation) and an increase in mortgage rates.

Even in the high-end market, buyers prized value and homes in tip-top condition and with functional floor plans. Those home buyers willing to renovate were scarce.

Housing affordability continued to be a hot topic in the news, and home prices rose at a robust pace this summer – 7% for single-family detached and a whopping 10% for condos and townhomes. However, historical data suggests the cost of buying a home may be LESS than it was a decade ago (see the page 1 sidebar). Some well-paid consumer advisors have warned potential home buyers to rent instead of buy, describing the market as “overinflated.” The increase in home prices is short-lived. In reality, the average home sales price increase in the Atlanta MLS is just 1.8% per year over for the past 11 years. Certainly not an “overinflated” market.

What does the future hold for Atlanta real estate? If affordable new home construction ramps up, the local real estate market would benefit because new construction keeps resale prices in check. New construction also provides the new home supply the area so desperately needs. All segments of the Atlanta real estate market would also benefit from more home buyers who are willing to renovate. Demand for housing continues to outpace supply by a wide margin, but demand is more heavily concentrated on “move-in ready” homes at the expense of great investment opportunities.

What Others are Saying About the Housing Market

______________________________________________________________

Another record selling summer season!

The number of $1 million-plus listing for sale that expired seemed to reach historic numbers this summer. At Beacham however, we’ve retained and sold more listings than at any time in our history despite a down overall market. Why? Many of the reasons for our success are contained in this newsletter, but there is much more to the story. If your home is off the market because it didn’t sell, contact us to find out why our listings are selling.

The early fall 2018 Beacham Insider also features:

- Latest Changes to Your 2018 Property Tax Bills

- Recent Updates from our Relocation Department

- Beacham Gives Back Q3 Charity Initiatives

- How Real Estate is Changing

Read full issue to see a more detailed summer housing market update.

# # #

Beacham & Company, REALTORS is Atlanta’s top-selling luxury real estate office. The firm was founded in 2006 by Glennis Beacham, one of Atlanta’s most celebrated real estate agents. The firm has 100 agents who average $7 million in sales per agent, more than any other Atlanta real estate firm.