PHOTO CAPTION: The Atlanta real estate market needs more homes on the market like this one at 2439 Lowe Street in the Riverside neighborhood of Atlanta. Located near the new Publix under construction at Moores Mill and Defoors Ferry Roads, it went on the market for $219,000 and was under contract within hours.

Editor’s Note: This story was first published April 29, 2016 but was updated on June 7, 2016.

Atlanta real estate picked up where it left off in 2015 with a strong start to 2016 according to the most recent issue of The Beacham Insider. Sales of single family detached homes and condos in the five county metropolitan area (Cobb, DeKalb, Forsyth, Fulton, Gwinnett) were up 10.6% in the first three months of the year while the average home sales price increased 6.6%.

Consistent with trends since the housing recovery began in 2011, the broader market led the way compared to the Beacham Bellwether index of Atlanta’s most desirable neighborhoods (page 4 of Insider). The Bellwethers are neighborhoods that have average sales prices far exceeding the city’s average sales price and are typically in top performing public school districts or close to job centers such as Buckhead, Perimeter, Midtown, Cumberland and Windward. The Bellwethers were up 7.9% but the broader market (excluding Bellwethers) was up 10.8%.

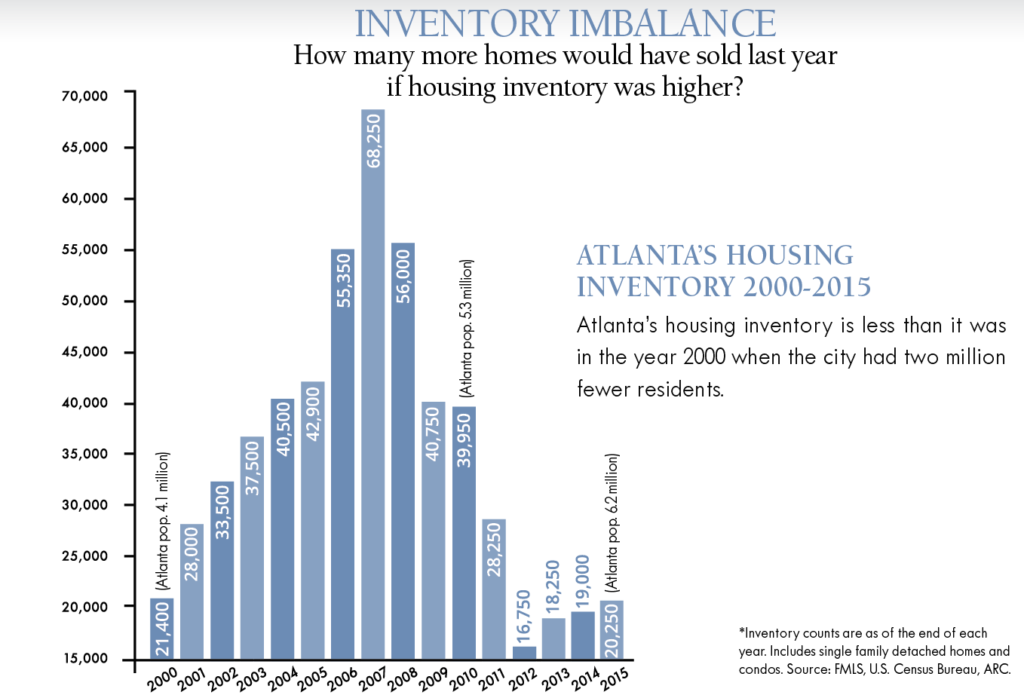

It is believed that lack of (desirable) housing inventory is holding back Bellwether neighborhoods from fostering a more robust sales environment. The months’ supply of inventory in Bellwether areas priced less than $500,000 is less than three months (see February issue of Beacham Bulletin). NAR says a healthy market is when there is a six months’ supply of inventory. The months’ supply of homes priced $500,000 to $750,000 is close to the NAR target balance, while there is an over-supply of homes priced more than $750,000. In fact, housing inventory is less than it was in 2000 when the city had two million fewer residents (see chart at bottom of article).

UPDATE: National Association of Realtors chief economist Lawrence Yun recently noted in an article for REALTOR Magazine that the number of home sales in the United States might be as much as 15% higher if home builders delivered the type of inventory the market needs (chiefly, product for first-time home buyers).

Demographic factors are having an effect on the Bellwether neighborhoods as well. Forbes recently ranked Atlanta as America’s most rapidly aging city. Atlanta’s senior population (age 65+) grew 20 percent between 2010 and 2014, well above the average 11.3 percent increase seen across the country’s 53 largest metropolitan areas. Top performing public schools are less important to Baby Boomers so declining demand from them may be exacerbated in the Bellwethers.

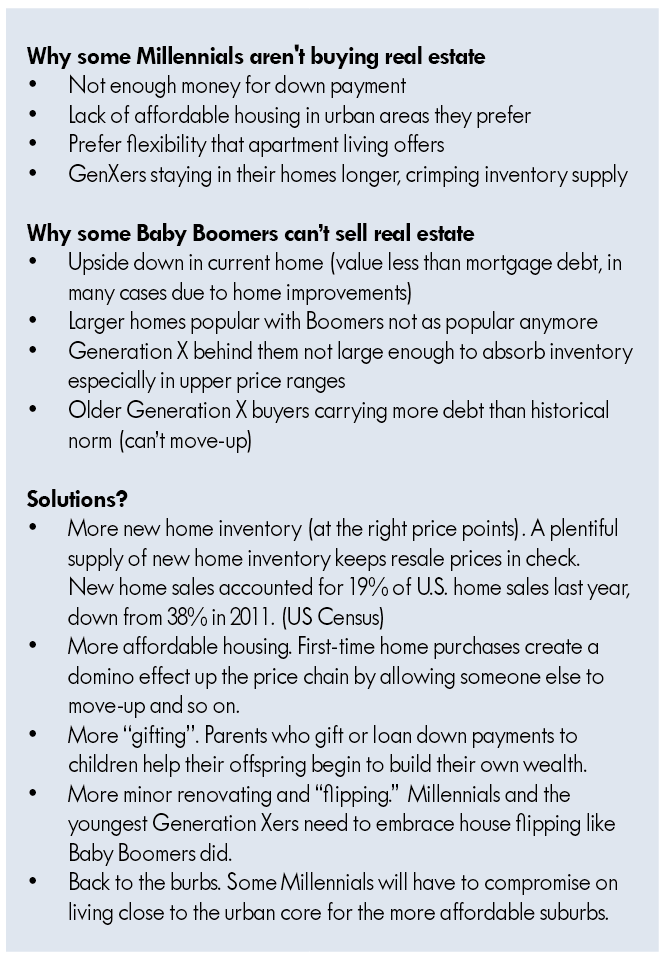

The Millenial generation (born after 1980 to 2000) became the largest segment of the home buying market last year according to the National Association of Realtors (NAR) and now they are the largest living generation in history. However, financial hardships (see Wall Street Journal article) and tougher lending standards since the Great Recession have combined to make the share of first-time home buyers the smallest in 30 years (NAR).

UPDATE: Yon also noted in his recent article that the average home sales price appreciation rate (5.7% over the last 12 months ending in April) is keeping many first-time home buyers out of the real estate market because wages only increased by 2% during that time. Traditionally, first-time home buyers make up 40% of all real estate transaction but currently they only comprise 30% of transactions.

Some question whether more inventory would make a difference right now. Millennials are more likely than any previous generations to postpone their first home purchase for their “forever house.” They also seem to prefer new to resale more than previous generations but delivery of new homes in Atlanta is not even halfway back to pre-bust (2005) levels and most of the multi-family under construction is apartments according to the U.S. Department of Commerce.

Generation X (born from the mid-1960s to early 1980s), is the tiny-by-comparison generation between the Baby Boomers and Millennials. Their smaller numbers and inability to absorb the volume of more expensive homes coming to market (and not coming to market) are making it more challenging for Baby Boomers to downsize. Also, many GenXers stayed put during the financial crisis and have either passed the point of trading up or simply can’t afford to trade up because they are carrying a higher debt load than traditional norms. Further complicating things are changes in buying tastes – huge homes with huge lots that were so popular with Baby Boomers are not as popular with GenXers and Millennials.

The good news is that in-migration to Atlanta remains strong although not as strong as job growth (nice problem to have) according to the Federal Reserve Bank of Atlanta. Also, there are some who see the maturing of Millennials as a coming sea change for the economy. Just as the Baby Boomer generation drove every economic cycle for the last several decades, Seattle-based investment fund manager William Smead believes in the irresistible force of Millennials’ sheer numbers.

Smead told The Wall Street Journal in an article published April 3: “In your life, you do four things that cause everyone else around you to do better economically, that are more impactful on the economy than anything else: you get married, have children, you buy bigger cars to accommodate the children and you buy a house. We’re about to have 86 million people do those things constantly for the next 10 years, and that’s why the U.S. economy will do extremely well.”

Let’s hope he’s right.