What’s Going on in Atlanta’s Housing Market?

We were hit hard, and fast. Factors leading up to the current economic slowdown were unusual, and vastly different than what led us to previous downturns in America’s past. Economist say this time is different; but how exactly?

1. The root of current downturn is not financial, but self-imposed due to a public health crisis

2. The accelerated speed of collapse

3. Scope of current downturn is vastly global

Spawned by a health crisis, not an unhealthy economy, Covid-19 knocked industries everywhere off their axis into unchartered water; real estate included. Atlanta has been experiencing high growth and development over the past few years, and even though Spring was slower, Summer 2020 is heating up. With more new listings in June this year compared to 2019, Atlanta’s real estate market is picking back up….fast.

_________________________________________

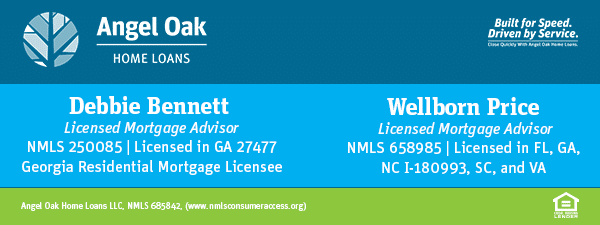

We sat down with our in-house mortgage lenders at Angel Oak Home Loans for a Q&A session on what they are seeing in the Atlanta market right now.

How is business right now for Atlanta mortgage lenders?

“It is CRAZY busy. Purchases and refinance applications are through the roof for all of us right now.”

Have you seen an uptick in loans, if so when did that begin?

“In the last 45 days. The mortgage industry has been speeding forward at a record pace.”

- Nationwide, applications for loans to purchase a home increased 5% the week of June 10, 2020 from the previous week and were 13% higher than June 2019, according to a report issued by the Mortgage Bankers Association.

- During the first week of June 2020, the demand for housing across the nation was up 25% from pre-pandemic levels, according to Redfin. Pending home sales in Atlanta was up 20% for the first week of June 2020 over June 2019, according to a report issued by MarketNSight. Nationwide, January through May 2020, pending sales are up 6% year over year same period for 2019.

What do you believe is the factor behind of all the recent high activity?

“Pent up demand, which is due to homeowners not wanting to put their house on the market, potential buyers wanting to take advantage of the low interest + mortgages rates and the recent wave of people who have just gone back to work.”

What are you seeing right now in the luxury market?

“Jumbo rates have come down to the mid – low 3’s, resulting in both high-end buyers AND sellers taking advantage of the current market. Low rates paired with low inventory has allowed people to sell homes extremely fast and buyers are able snatch up properties with a low rate.”

What do you see happening to the market in the long run – with the current low rates, record low inventory, reopening of the economy and potential homebuyers facing heavy competition & paying over market value in bidding wars for homes?

“I think the next twelve months, residential real estate will be hot. It is very difficult to predict what the fall will bring from a perspective of COVID and the housing market. According to Realtor.com, rates are predicted to remain low through the rest of the year, home prices have increased, and listings are selling quickly – not many are remaining long in the market. The past two months have brought a tremendous rebound to the housing market. Employment is up 13% according to the Department of Labor, forbearance has dropped by 47,000 week over week since the peak the week of May 22, 2020 according to Fannie Mae and Freddie Mac., and rates are at a historical low level.”

“We know a lot more now and have enhanced technology to ensure the safety of buyers and sellers during the pandemic. Virtual tours and closings can be done remotely and safely. We can streamline document sharing and have a mobile app for homebuyers to apply for a loan and manage the entire process from their mobile phone.”

“There are no forecasts or reports issued with any certainty of a potential housing market crash and in March we did not experience a repeat housing crash from a decade ago. We are optimistic with the favorable market we are seeing right now and Angel Oak Home Loans has had strong performance month over month in 2020. Based on this information and reports issued by Fannie Mae and Freddie Mac, the next year looks like it will be strong for the housing market even without the refi boom that we are seeing right now.”

How does Angel Oak’s Atlanta market compare to other offices in the Southeast in terms of the number of loans coming through? Is one state busier than another?

“All of our offices are clicking away at relatively the same speed. Atlanta’s market has been amazing these few last years, so I wouldn’t be surprised if we are above a lot of cities in regards to numbers. Angel Oak is currently hiring support staff in all areas to keep up with the high demand. I don’t foresee this slowing down anytime soon.”

How is this current economic situation different from the recession that began in 2007?

“The recovery time with this current economic situation will be must faster compared to 2007 recession. This crisis was caused by COVID-19, not a credit crisis or one based on lowered lending standards, and that is the distinct difference. Today, non-QM is based on performing, quality loans issued to buyers who can prove their ability to repay their mortgage. We adhere to guidelines and responsible underwriting. There is a significant population of credit worthy borrowers out there and they require mortgage loans outside of conventional financing. These factors played into a quick rebound.”

What the most important thing lenders are looking at right now when it comes to loan approval, and is there anything mortgage lenders are paying closer attention to this time around after what happened in 2010?

“We are still looking at the basics: Credit, % Down Payment and Income(s). The income piece has gotten slightly more complicated, specifically for W2 employees who are being furloughed and self-employed borrowers who are trying to get their business back up and running, either at a normal or slightly less than normal income level.”

“Taking extra steps and verifications for W2 and self-employed borrowers. We typically require a paycheck right before closing to verify that the person has not just received a sudden pay cut. For self-employed borrowers, we are focusing on their most recent bank statement to confirm they are still receiving income.”

Is there any advice you would give a potential buyer or seller in Atlanta right now? Should they wait to list or buy? Is there anything to be wary of?

“The market in Atlanta, and for the majority of the country, is favorable right now. The summer remains a great time to buy before the start of school. Anyone looking to purchase a home should consult a lender to understand their loan options based on their unique situation. We have traditional loans and non-traditional loans made up of non-QM products based on varying circumstances. We have products that may help eligible self-employed buyers, property investors, and those with credit events. We are here to help and determine how best to go about the loan process. There is no reason to be wary with so much available information. Start with a lender, get educated on the loan process, how it relates to your situation, and understand the market. For those who are selling, now is a good time as inventory is down and listings are selling fast!”